I’m privileged to have been asked to speak at a major Student Housing conference in London today. The Property Week hosted event is in it’s 8th year and has sold out; we can expect to see well over 500 people there. I’ve spoken at other industry events on Student Living, but this is my first time here – and its widely regarded as the big one.

One of WCEC’s current projects; currently in Planning.

One of WCEC’s current projects; currently in Planning.

It’s been another incredibly strong year for UK Student Living. It’s anticipated that the year will close with over £5.7bn of investment recorded; that’s bigger than ever before. However almost all of that is transactional activity of existing operational assets, not new development supply. There is still strong interest from investors and developers in building new product, but there are some challenges to overcome.

Most major university cities have strong supply already. There will always be opportunity for growth and diversification, but its not simple to do, despite what some might think. Location, location, location remains a major factor for Student Living; it is housing after all. Beyond that the image below outlines some of the issues which are affecting the viability of building new Student Living at the moment. The basis of the problem is that the required capital investment is outweighing income potential, especially for the lower-mid level “affordable” offer. This is arguably where the greatest volume of demand exists. It’s become much harder to make the numbers work. But some, who know what they are doing and create an angle, can make it stack up.

The basis of the problem is that the required capital investment is outweighing income potential, especially for the lower-mid level “affordable” offer. This is arguably where the greatest volume of demand exists. It’s become much harder to make the numbers work. But some, who know what they are doing and create an angle, can make it stack up.

Premium/ Studio led projects work, with weekly rentals of £250+, but only a small proportion of students can afford £10k a year to live in an ultra cool pad. They also have their tuition fees and living expenses which could easily add another £15k to that.

In my talk and panel session, we’ll be exploring how developers can create a competitive edge through design led schemes. This is recognised as a key differentiator now, but its easy to make mistakes and follow established trends which wont create a distinct angle. I’ve seen some great projects delivered this year, in the UK regions, in London and also in Europe. Quality is consistently high on the agenda, but its so easy to overspend on delivering it – and in areas which are unnecessary I think.

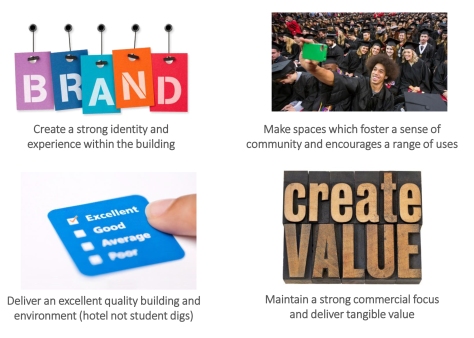

Despite public perceptions, students are discerning customers, with needs and demands which reflect hotel quality living, as apposed to the traditional student digs – or a hostel type offer. They want to be engaged in a community environment which blends living, relaxing, socialising and studying. These are the essential ingredients for Student Living. Some of this is physical, but some is about the brand and the operational function as well.

The challenge we all face in delivering new student living buildings is to create something which delivers quality in all areas, but which is also commercially viable and realistic. To do this takes experience and skill; it will consist of a considered blend of design, space, specifications and also operational strength.

My talk concludes with four areas which, in my opinion, define how design can give new student living buildings a competitive edge… You can see a copy of my presentation in .PDF format by clicking on the image below…

You can see a copy of my presentation in .PDF format by clicking on the image below… You can also read an insightful Property Week publication on the changing dynamics of the student living sector by clicking here.

You can also read an insightful Property Week publication on the changing dynamics of the student living sector by clicking here.

Want to talk more about student living design?…

WCEC Architects are working on a range of really dynamic student living projects at present; for both private developers and universities alike. Some of these are new-build, others are refurbishments/ conversions. We are designing new concepts which explore compact living ideas, along with reinventing the traditional cluster apartment. We are also designing premium studio led projects with market leading providers. The fact our team have been involved in over 16,000 beds in the last ten years demonstrates to our clients that we know our stuff. We can create and add value. You can contact me by email by filling out the form below